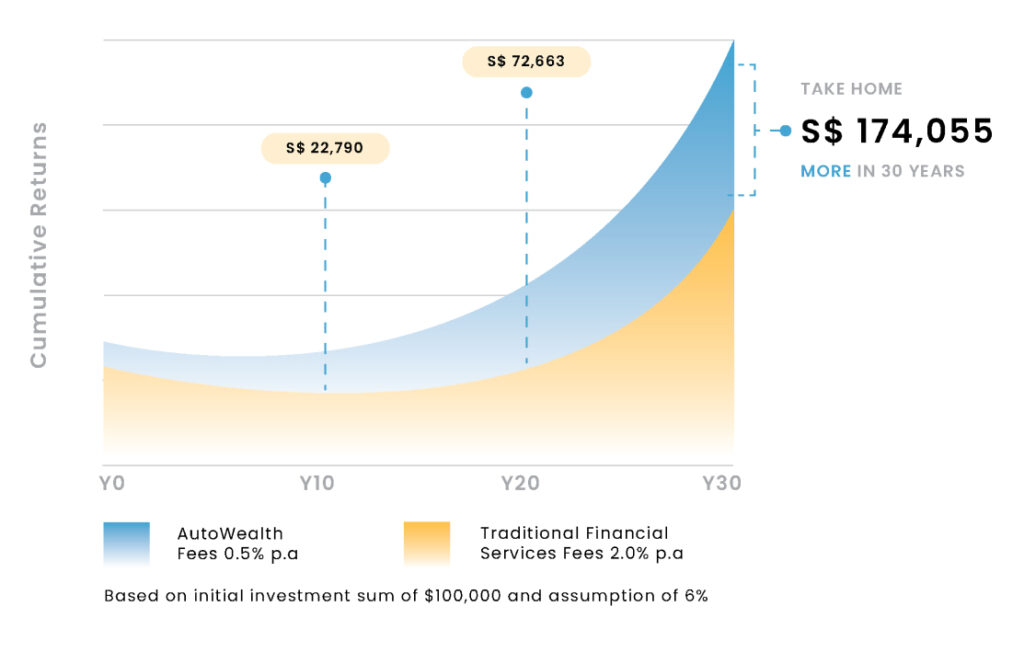

Take Home More With & Lower Fees

FEES & PRICING

For a S$10,000 AutoWealth Starter portfolio, the fees we charged is about $74 per annum or about $6 per month. For a service that makes a lot more money and achieves important financial goals for you, the cost we charge is less than a Netflix / Spotify monthly subscription.

Illustration for One-off S$100,000 Investment

Illustration for One-off S$100,000 Investment

AutoWealth capitalises on technology and reinvents the investment process to eliminate unnecessary fees and pass these cost savings to YOU !

Our COMMITMENT To You

Frequently Asked Questions (FAQ)

AutoWealth Flexi Cash charges 0.1% and AutoWealth Starter charges 0.5%+USD18. For AutoWealth Plus+ fees and charges is 8% performance fees on profits.

No. However, the AutoWealth Starter consists of the Platform Fee of US$18 per annum (Flat Fee) regardless of the investment amount.

No, transaction and custody fees will be absorbed by AutoWealth. Therefore, AutoWealth clients enjoy lower transaction and custody costs vis-à-vis DIY investors.

The fees for AutoWealth Starter and Flexi-cash are deducted on a quarterly basis, while AutoWealth Plus+ fees are deducted at the end of the calendar year.

When withdrawing in USD, AutoWealth does not impose additional fees.

However, as the beneficiary, you will receive your payment minus any applicable fees imposed by the correspondent (intermediary) bank and/or the receiving bank. As these fees may differ from bank to bank, please contact your bank representative directly for more details.

This does not apply to withdrawals in SGD.