Invest With AutoWealth Plus+

AutoWealth Plus+

19.97%*

As of 30th June 2023

Based on the 5-Year Annualized Returns for the Future 2050 Portfolio

Strategy

Key Characteristics

Higher Returns

Professionally managed thematic portfolio aimed at maximizing gains from long-term trends while delivering double-digit returns

Annual Performance Based Fees

- With AutoWealth Plus+, you'll only be charged when your investments generate positive returns.

- AutoWealth Plus+ offers a revolutionary fee structure where we co-share part of the risk by charging an annual performance fee of just 8% on profits earned in each calendar year.

Who Should Invest ?

Investors seeking to capitalise on long term macro trends

Investors with higher risk appetite and longer investment horizons

Introducing our exclusive Autowealth Plus+ Portfolios

Invest in promising long term trends with AutoWealth Plus+

Future of New Economies Portfolio

Future 2050

Portfolio

Future of Digital Economy Portfolio

Growth & Momentum Portfolio

Turnaround Portfolio

Star of AutoWealth Plus+ Portfolio The Future 2050 Portfolio

Star of AutoWealth Plus+ Portfolio

The Future 2050 Portfolio

Futuristic technologies and disruptive innovations drive the growth of technology companies, while healthcare companies are poised to benefit from macro trends like the aging population and increasing longevity, which present significant resource imbalances. Minimum volatility companies exhibit lower volatility and drawdowns compared to their peers, making them relatively more defensive against market volatility and economic downturns.

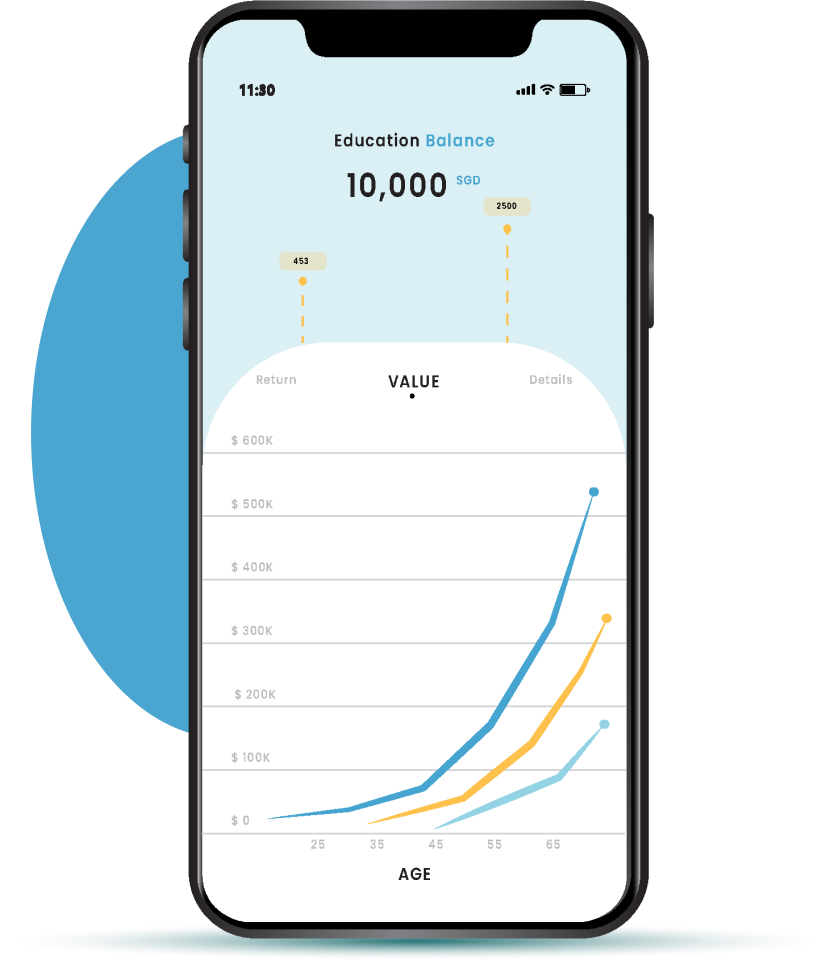

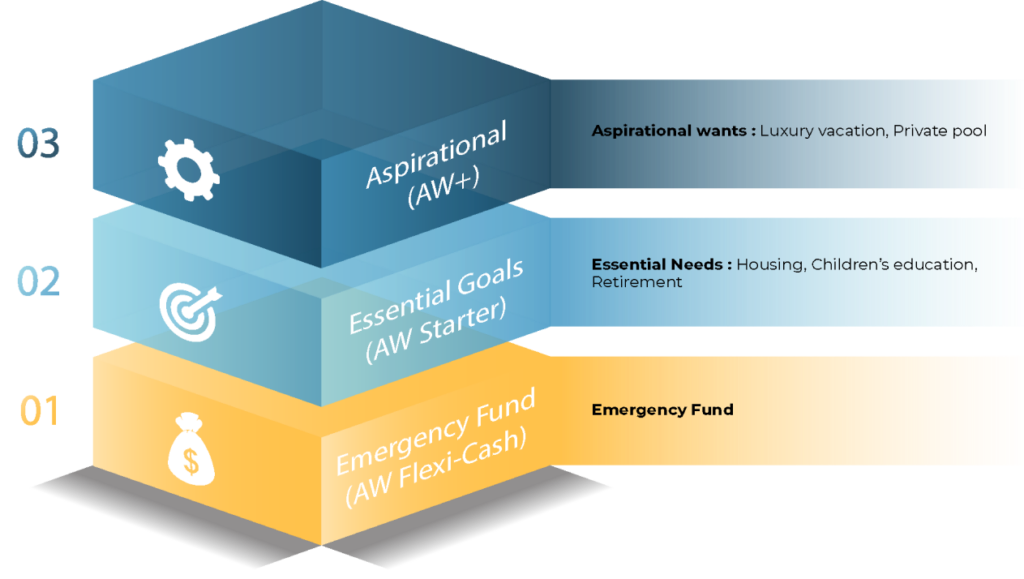

How Does Invest AutoWealth Plus+ Fit Into Your Financial Planning ?

After you have accomplished your fundamental life goals, you can consider using your surplus funds to invest in more ambitious endeavors, such as an ocean-view condo. AutoWealth Plus+ has been specifically created to assist you in achieving these aspirations and should only be invested in after you have made a reasonable commitment to attaining life’s essential goals.

AutoWealth Plus+ Fees

8%

Only on your profits